Introduction:

Launching a cleaning startup in 2025 is one of the smartest business decisions you can make. The industry is booming, client demand is global, and startup costs are relatively low.

But here’s the catch — many entrepreneurs fail to realize that before landing contracts, they need to meet specific cleaning license requirements. Without proper registration, permits, and insurance, you can’t secure corporate clients or legally scale your business.

This 5,000+ word complete guide walks you through every step — from business registration to environmental compliance — covering Pakistan, UAE, UK, US, and other key global markets.

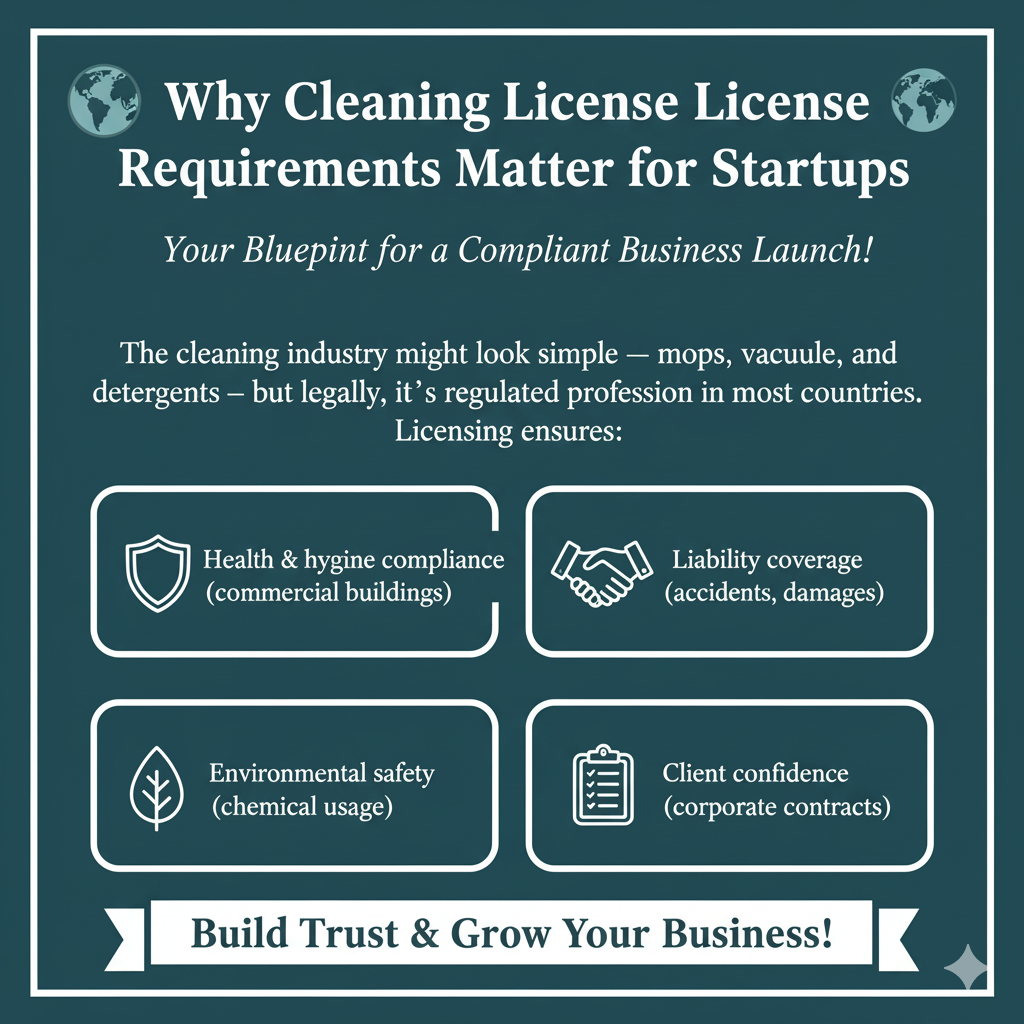

🌍 Why Cleaning License Requirements Matter for Startups

The cleaning industry might look simple — mops, vacuums, and detergents — but legally, it’s a regulated profession in most countries.

Licensing ensures:

- Health and hygiene compliance (especially for commercial buildings)

- Liability coverage (in case of accidents or damages)

- Environmental safety (chemical usage, disposal)

- Client confidence (corporate contracts require proof of licensing)

💡 Fun Fact: In the US and UK, 70% of facility management contracts are awarded only to licensed and insured cleaning businesses.

🧾 1. Register Your Cleaning Business Officially

The foundation of every cleaning startup begins with business registration. Without it, you can’t get tax IDs, bank accounts, or licenses.

| Region | Registration Authority | Type of Registration |

|---|---|---|

| 🇵🇰 Pakistan | FBR + SECP | Sole Proprietor / Pvt Ltd |

| 🇦🇪 UAE | DED (Dubai), Sharjah DED | Commercial License |

| 🇬🇧 UK | Companies House | Limited Company / Sole Trader |

| 🇺🇸 USA | State Business Office | LLC or Sole Proprietorship |

| 🇨🇦 Canada | CRA | GST/HST Registered Business |

Tip: Include the word “Cleaning Services” in your company name for branding and SEO value.

2. Obtain a Trade or Business License

After registration, apply for a Trade License or Business Permit from your local authority. This is mandatory to legally perform cleaning operations.

Required Documents:

- Copy of registration certificate

- Owner’s ID (CNIC or Passport)

- Business lease or property ownership proof

- Municipal or environmental NOC (if applicable)

- Application form + fees

💬 Example:

In Dubai, apply under Activity Code 74930 – Cleaning Services via DED.

In Pakistan, apply for a Trade License from your Cantonment Board or Municipal Committee.

🧾 3. Get a Tax Identification Number (TIN/NTN)

Tax registration allows you to invoice clients legally and file taxes.

| Country | Tax Number | Issuing Authority |

|---|---|---|

| 🇵🇰 Pakistan | NTN | Federal Board of Revenue (FBR) |

| 🇺🇸 USA | EIN | IRS |

| 🇬🇧 UK | UTR | HMRC |

| 🇨🇦 Canada | BN | CRA |

| 🇦🇪 UAE | TRN | Federal Tax Authority |

Pro Tip: Registering for taxes early helps when bidding for government or large contracts.

4. Liability & Employee Insurance Coverage

Cleaning businesses often work in sensitive environments — offices, hospitals, malls, or private homes. A single accident or chemical spill can lead to major claims.

Essential Insurance Types:

- General Liability Insurance: Covers damage to client property.

- Workers’ Compensation: Required if you hire staff.

- Equipment Coverage: Protects cleaning tools and vehicles.

- Professional Indemnity: Covers service errors or negligence.

💬 Example:

In the US, many cleaning startups use providers like Hiscox or Next Insurance for small business coverage.

⚖️ 5. Health, Safety & Environmental Compliance

In 2025, global standards are stricter on cleaning chemicals and worker safety.

Requirements include:

- MSDS (Material Safety Data Sheets) for all cleaning agents

- PPE (Personal Protective Equipment) training for staff

- Environmental disposal plans

- Hygiene certifications (especially for hospital cleaning)

In countries like UAE and UK, Health Departments may audit cleaning companies annually for compliance.

💡 Pro Tip: Switching to eco-friendly and plant-based cleaning products makes approvals easier and enhances your brand image.

🧾 6. Specialized Permits (If Applicable)

Depending on your niche, you might need special cleaning permits:

| Cleaning Type | Extra Permit Needed |

|---|---|

| Pest Control | Environmental License |

| Water Tank Cleaning | Health Department NOC |

| HVAC Cleaning | Technical or Mechanical Permit |

| Industrial Cleaning | Safety Audit / Hazard Approval |

Each permit increases your credibility and allows higher service pricing.

7. Premises or Operational Base Approval

Most cities require startups to have a registered business address or office for inspection.

Authorities often check:

- Proper waste disposal setup

- Chemical storage conditions

- Worker safety arrangements

- Fire safety measures

If you’re starting small, you can use a shared office address or warehouse until you expand.

🧮 8. Financial and Banking Setup

Once licensed, open a business bank account to manage finances transparently.

Documents required:

- Company registration

- License copy

- Tax ID

- Proof of address

💡 Tip: Use accounting software like QuickBooks or Zoho Books to maintain financial records — useful during tax audits or license renewals.

🧾 9. Employee Training & Certification

Skilled and certified cleaners increase your brand’s reputation. Some countries (like the UK or UAE) require proof of staff training in hygiene and safety.

Recommended Courses:

- Basic Cleaning & Disinfection

- Chemical Handling Safety

- Customer Service & Communication

Certificates can be obtained from:

- Local Technical Institutes

- OSHA (for US compliance)

- ISO 9001/14001 training providers

📋 10. Annual License Renewal & Audit

All cleaning licenses must be renewed yearly.

Renewal Checklist:

- Updated insurance policy

- Renewal fee payment

- Updated employee list

- Tax clearance certificate

💡 Warning: Operating with an expired license can lead to fines or business closure in most regions.

🌎 Cleaning License Requirements by Region

🇵🇰 Pakistan

- FBR registration (NTN)

- Municipal Trade License

- Environmental NOC (if chemicals used)

🇦🇪 UAE

- DED license (Cleaning Services Activity Code 74930)

- Labor approval for foreign staff

- Health & Safety compliance

🇬🇧 UK

- Register with Companies House

- Get public liability insurance

- Comply with Health & Safety at Work Act

🇺🇸 USA

- Business registration (State level)

- Business License + EIN

- Worker’s Compensation + Liability Insurance

🇨🇦 Canada

- CRA registration

- Provincial business license

- Workplace insurance and tax compliance

💬 FAQ Section – Cleaning License Requirements

Q1: Do I need a license to clean homes privately?

➡ Yes, even home-based cleaning businesses require registration in most regions.

Q2: How long does the cleaning license process take?

➡ Typically 2–4 weeks, depending on documentation and inspection schedules.

Q3: What’s the cost of licensing a cleaning startup?

➡ Around $100–$500 depending on country and type of services.

Q4: Can foreigners start cleaning companies in the UAE or UK?

➡ Yes, through partnership or company formation procedures.

Q5: What happens if I skip licensing?

➡ Fines, blacklisting, and loss of access to business clients.

Sources:

Internal Links:

- How to Get a Cleaning Business License (2025 Guide)

- Eco-Friendly Cleaning Methods

- Post-Construction Cleaning Services

Source

- FBR Pakistan – NTN Registration

- DED Dubai – Business Setup

- IRS – EIN Application (USA)

- UK Gov – Set Up a Business

🧠 Expert Advice: Cleaning License Requirements

Understanding Cleaning License Requirements is not just about legality — it’s about professionalism, safety, and client trust.

Startups that meet these requirements early not only avoid penalties but also gain a competitive edge in 2025’s cleaning market.

💬 Remember: A properly licensed cleaning business is not a small venture — it’s a recognized service provider ready for long-term success.

5 Comments