Introduction

Cleaning company tax can be confusing, especially when it involves (Value Added Tax) VAT & GST (Goods and Services Tax). Whether you manage residential cleaning, office janitorial contracts, or industrial sanitation, taxes impact how you price services, invoice clients, and handle compliance.

In 2025, governments continue tightening indirect tax compliance — meaning every cleaning business must understand how VAT & GST apply, when to register, how to claim input tax credits, and what invoicing and filing rules apply.

This guide breaks down everything you need to know about VAT and GST for cleaning companies — simplified, practical, and compliant with current global tax frameworks.

What Is VAT & GST ? (The Basics)

VAT (Value Added Tax) and GST (Goods and Services Tax) are consumption-based taxes levied on goods and services. They’re indirect — meaning the tax is paid by consumers but collected and remitted by businesses.

Key Concept

At each stage of production or service delivery, VAT/GST is charged on the “value added.” Cleaning companies charge VAT/GST on their services and can deduct the tax they’ve paid on inputs such as cleaning materials, detergents, and tools.

| Term | Explanation |

|---|---|

| VAT (Value Added Tax) | A multi-stage tax on the value added at each point of supply. |

| GST (Goods and Services Tax) | A unified version of VAT covering both goods and services under one system. |

| Input Tax Credit (ITC) | A deduction for the tax paid on business purchases (inputs). |

| Output Tax | The VAT/GST you charge customers on sales or services. |

Example:

If your cleaning firm charges $1,000 + 10% GST to a client but has paid $100 GST on cleaning supplies, you’ll remit only $900 × 10% − $100 = $0 tax. The government collects the net difference.

How VAT & GST Apply to Cleaning Companies

1. Service Classification

Cleaning services are usually categorized under professional or maintenance services, making them taxable supplies under VAT/GST law.

However, residential cleaning may sometimes be exempt or zero-rated in some countries — while commercial and industrial cleaning are fully taxable.

2. Registration Thresholds

Most tax authorities set turnover thresholds that determine when a cleaning company must register for VAT/GST.

- Pakistan: Provincial Sales Tax applies to services (13–16% rate). (Grant Thornton Pakistan

- UK: VAT threshold at £90,000 annual turnover.

- Australia: GST threshold AUD 75,000 annual turnover.

- Canada: GST/HST registration required above CAD 30,000 revenue.

- Even if your cleaning company is below the threshold, voluntary registration can help you claim input tax credits.

Invoicing & Documentation Requirements

Every cleaning company registered for VAT/GST must issue compliant tax invoices.

A valid invoice should include:

- Supplier name, address, and tax registration number

- Invoice date and serial number

- Customer name and address

- Description of cleaning services

- Total amount before tax

- Tax rate and amount

- Total amount payable including VAT/GST

Many countries (e.g., India, Saudi Arabia, EU) now mandate e-invoicing — cleaning firms must upload invoices electronically to tax authorities’ systems.

💡 Pro Tip: Automate invoices using accounting tools like QuickBooks Online or Zoho Books to maintain digital records and simplify tax filing.

Time of Supply — When Tax Applies

Understanding time of supply is essential to know when to charge VAT/GST.

| Scenario | Time of Supply Rule |

|---|---|

| One-time cleaning | When service is completed or invoice issued, whichever comes first |

| Ongoing contracts | Tax applies on each periodic payment or milestone |

| Advance deposits | Tax is due when payment is received, even before service starts |

Failing to apply the correct timing can result in interest or penalties for under-reporting.

Taxable vs Exempt Cleaning Services

Not all cleaning services are taxed the same way.

| Type of Cleaning | Common Treatment | Example Jurisdictions |

|---|---|---|

| Residential / Domestic | Often Exempt or Reduced Rate | UK (Reduced VAT), Australia (Input-taxed) |

| Commercial / Office | Standard Rate | Pakistan, UAE, EU |

| Industrial / Factory | Standard Rate | India, Malaysia |

| Healthcare / Elderly Care Cleaning | Sometimes Exempt | EU, Canada |

| Government Buildings | Usually Taxable | Most regions |

Source: Check local tax categories in the EY Worldwide VAT, GST & Sales Tax Guide (2025)

Input Tax Credit (ITC) for Cleaning Company Tax

The Input Tax Credit allows you to deduct VAT/GST paid on purchases used in your business operations.

Eligible Inputs

- Cleaning chemicals, tools, and supplies

- Uniforms and protective equipment

- Vehicle fuel (if used for business)

- Office rent and utilities

- Professional software or outsourced accounting

Non-Eligible Inputs

- Entertainment expenses

- Personal consumption items

- Gifts or staff meals

- Non-business use of assets

Documentation needed:

- Supplier invoices with VAT & GST number

- Proof of payment

- Proper linkage to business use

Related Post See our related guide on Accounting Best Practices for Service Businesses

Cross-Border and Digital Cleaning Contracts

If your cleaning company operates across borders — for example, contracts in multiple provinces or countries — place of supply rules determine which region’s tax applies.

Example:

A Pakistani cleaning company performs services in Dubai.

- The place of supply is where the service is performed (Dubai).

- The local VAT (5%) applies, and the Pakistani business may register under UAE VAT. (PwC Middle East VAT Guide

For digital cleaning service platforms (e.g., apps matching cleaners and clients), tax authorities may classify the service as electronic supply, attracting VAT under digital tax laws.

Compliance and Filing Requirements

VAT/GST returns summarize total taxable supplies, input credits, and payable taxes.

| Country | Filing Frequency | Digital Submission Required? |

|---|---|---|

| Pakistan | Monthly / Quarterly | Yes (Provincial portals) |

| UK | Quarterly | Yes (MTD – Making Tax Digital) |

| UAE | Quarterly | Yes (FTA e-portal) |

| Australia | Quarterly | Yes (BAS portal) |

| Canada | Monthly / Quarterly | Yes |

Key Filing Steps:

- Calculate total output tax collected.

- Subtract input tax credits.

- File the return electronically before the due date.

- Pay any net tax owed.

- Maintain audit-ready records for at least 5 years.

Late filing penalties can reach 10–20% of tax due, depending on your jurisdiction.

VAT & GST Rates Around the World (2025 Update)

| Country | Standard Rate | Notes |

|---|---|---|

| Pakistan | 15–18% | Provincial service tax applies |

| UAE | 5% | Simplified VAT regime |

| UK | 20% | Reduced rate for domestic cleaning (5%) |

| Canada | 5–15% (GST/HST) | Varies by province |

| India | 18% | Cleaning under standard services |

| Australia | 10% | Applies to most cleaning contracts |

| Singapore | 9% (from 2024) | GST increase continued |

| EU Average | 20–23% | Harmonized across member states |

Technology and Automation in Cleaning Tax Compliance

Modern accounting tools simplify tax management. Using cloud-based software ensures accurate calculation, e-invoicing, and timely filing.

Recommended Tools:

- Xero – Automates VAT returns and real-time reconciliation

- QuickBooks Online – Integrated GST reporting for small businesses

- Zoho Books – Localized GST templates for Asia & MEA

- Avalara – Global VAT automation and tax code mapping (Avalara)

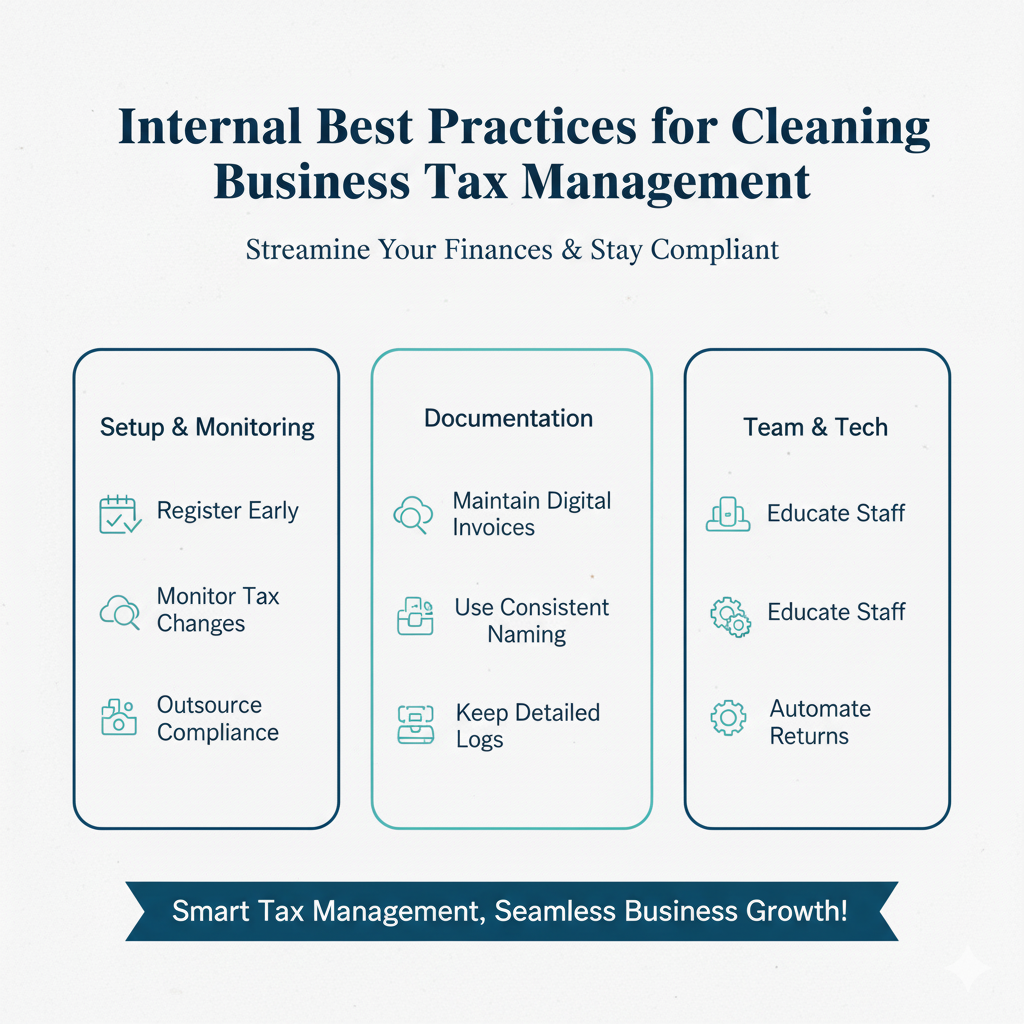

Internal Best Practices for Cleaning Business Tax Management

- Register early – Avoid penalties for delayed registration.

- Maintain digital invoices – Required for audits.

- Use consistent naming – Avoid mismatches in client invoices.

- Monitor tax changes – Follow local revenue authority updates.

- Outsource compliance – Hire professionals for periodic review.

- Educate staff – Train admin teams on VAT/GST invoice rules.

- Automate returns – Reduce manual entry and human error.

- Keep detailed logs – Record all expenses with tax codes.

Common Mistakes – Cleaning Company Tax

- Charging VAT when under exemption limits

- Forgetting to claim input tax credits

- Incorrectly apportioning residential vs commercial services

- Using unregistered suppliers (invalid input credit)

- Late filing or missing tax deadlines

- Failing to issue valid tax invoices

Avoid these by integrating compliance into daily operations — not just year-end accounting.

Frequently Asked Questions (FAQ) – Cleaning Company Tax

Q1. What is the cleaning company tax?

A1. It refers to VAT or GST applicable on cleaning services, charged to clients and remitted to the tax authority.

Q2. Do all cleaning businesses have to register for VAT & GST?

A2. Only if turnover exceeds the registration threshold, or if you choose voluntary registration for claiming input tax credit.

Q3. Is residential cleaning taxable?

A3. Often exempt or charged at reduced rates depending on jurisdiction.

Q4. How often must I file VAT returns?

A4. Usually monthly or quarterly, based on your country’s requirements.

Q5. Can I claim VAT & GST on cleaning supplies?

A5. Yes — if they’re used for taxable business purposes and from registered suppliers.

Q6. What happens if I miss my filing deadline?

A6. Late fees, penalties, or audits may apply. Always file before due dates.

Q7. How do I know which province’s tax applies in Pakistan?

A7. The tax applies in the province where the service is performed. Check the respective provincial revenue authority.

Q8. Do subcontracted cleaners need to charge VAT?

A8. Yes, if they’re registered for VAT/GST. You can then claim their invoice tax as input credit.

Q9. Is equipment rental included in cleaning company tax?

A9. If billed together, yes — it’s part of the taxable service. If rented separately, it may be treated differently.

Q10. Can a small cleaning startup avoid VAT registration?

A10. Yes, if your turnover is below the legal threshold, but voluntary registration may still benefit you.

Expert Advice: Cleaning Company Tax

VAT & GST rules for cleaning companies in 2025 demand clarity, discipline, and compliance. Whether you’re a solo cleaner or managing a large janitorial firm, taxes can significantly impact profit margins if misunderstood.

Action Steps:

- Determine if your cleaning service is taxable or exempt.

- Register for VAT/GST with your local tax authority.

- Maintain clean records and compliant invoices.

- Claim input credits properly.

- File returns on time — digitally if required.

- Consult a tax advisor for ongoing updates.

By mastering cleaning company tax, you can keep your business compliant, avoid penalties, and maintain a professional reputation with clients and regulators alike.

2 Comments