Starting a cleaning business can be one of the most profitable and low-cost ventures worldwide. Whether you’re targeting homes, offices, or industrial sites — having a valid Cleaning Business License gives your company legitimacy, trust, and access to high-value contracts.

In this comprehensive guide, we’ll walk you through the 7 easy steps to get a cleaning business license, including registration, taxes, insurance, and compliance — so you can confidently start your cleaning venture anywhere in the world.

Step 1: Understand What a Cleaning Business License Is

A Cleaning Business License is the legal authorization from your local or national government that allows you to operate cleaning services — such as residential, commercial, industrial, or specialty cleaning (e.g., water tanks, HVAC, or carpet care).

🗂️ Types of Cleaning Licenses

- General Cleaning License: For residential & small offices

- Commercial Cleaning License: For large-scale contracts

- Specialized License: For HVAC, medical, or chemical cleaning

- Franchise License: If joining a brand or operating multiple branches

Step 2: Register Your Business Legally

Before you can get a cleaning business license, you must register your business entity.

🏢 Common Business Types

- Sole Proprietorship: Low-cost, for solo cleaners or small startups

- LLC / Pvt. Ltd. Company: Best for growing and multi-employee businesses

- Partnership / Corporation: Suitable for joint ventures or franchise operations

🌍 Registration Authorities by Region:

- 🇵🇰 Pakistan: FBR (for NTN) & SECP (for Pvt. Ltd.)

- 🇺🇸 USA: Local Secretary of State’s Office

- 🇬🇧 UK: Companies House

- 🇦🇪 UAE: Department of Economic Development (DED)

- 🇮🇳 India: Ministry of Corporate Affairs (MCA)

Source: SECP Pakistan Business Registration Portal

Related Topic: Step-by-Step Cleaning Company Registration Guide

Step 3: Apply for a Cleaning Business License

Once your business is registered, apply for your local trade or business license.

📋 Required Documents:

- Copy of business registration certificate

- National ID / Passport

- Proof of address

- Tax registration number (NTN, EIN, etc.)

- Health & safety compliance certificate

🕒 Processing Time:

Usually takes between 5 to 15 working days depending on the region.

Step 4: Get the Right Business Insurance

Insurance is essential to protect your cleaning company from damages, accidents, or legal claims.

🛡️ Common Types of Insurance:

- Public Liability Insurance: Covers accidents or property damage

- Workers’ Compensation: For employee injuries

- Professional Indemnity: Covers service-related claims

- Equipment & Vehicle Insurance: For vans, machines, and tools

Source: Compare Cleaning Business Insurance (Insureon)

Related Topics: Best Insurance for Cleaning Businesses in 2025

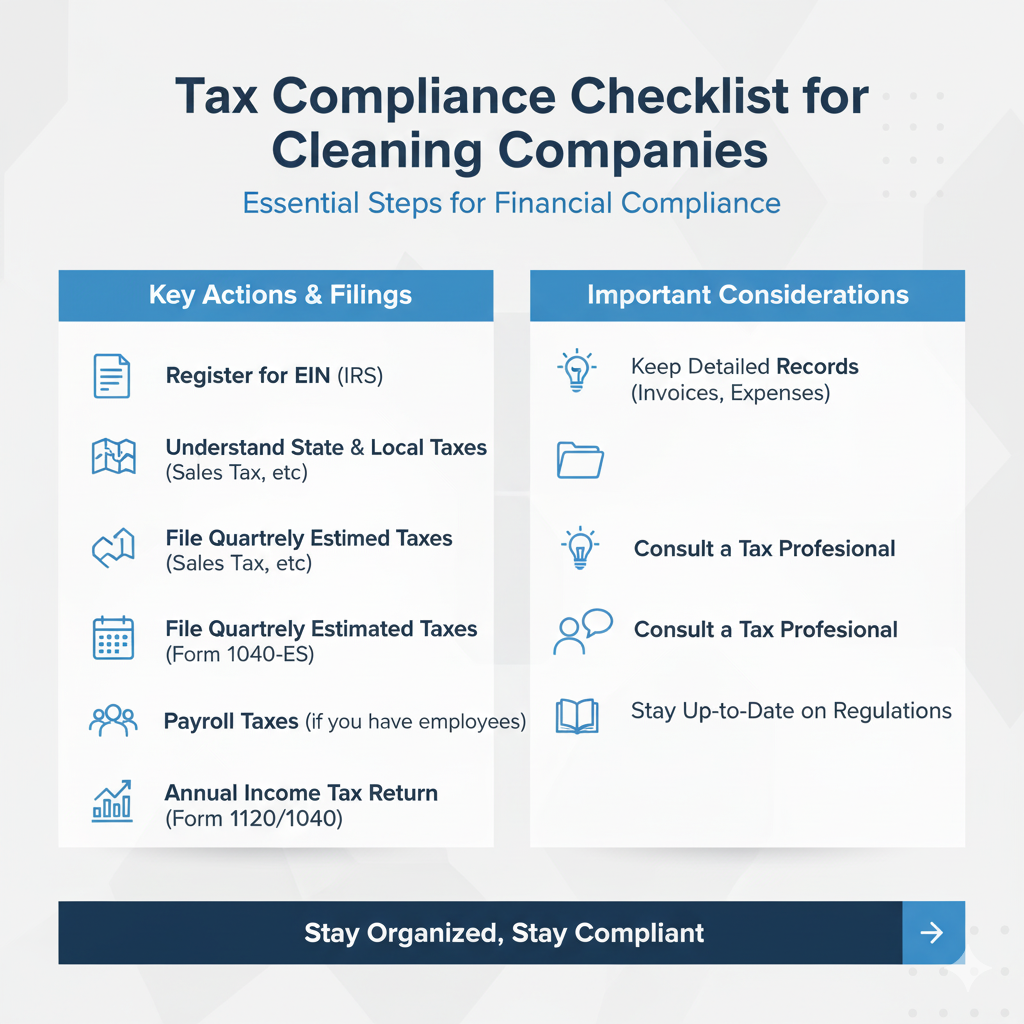

Step 5: Ensure Tax Compliance

Every licensed cleaning business must comply with national tax laws.

💰 Tax Requirements by Region:

- 🇺🇸 USA: Federal EIN + State Sales Tax

- 🇬🇧 UK: VAT registration if annual turnover exceeds £85,000

- 🇵🇰 Pakistan: Income Tax + Sales Tax registration (FBR)

- 🇦🇺 Australia: GST registration (for income above AUD 75,000)

📄 Common Tax Deductions:

- Cleaning supplies

- Uniforms & PPE

- Vehicle fuel

- Advertising & website costs

Step 6: Get Local Health & Safety Certification

Many cleaning services use chemicals or disinfectants — requiring a health, hygiene, or environmental certificate.

🧼 Examples:

- Environmental NOC (Pakistan / UAE)

- OSHA Safety Compliance (USA)

- Health Department Approval (UK / Canada)

Why Important:

- Builds client confidence

- Required for commercial or hospital cleaning contracts

Step 7: Maintain Renewal and Compliance

Once licensed, you’ll need to renew annually or bi-annually depending on your region.

🗓️ Renewal Checklist:

- Submit license renewal form

- Update insurance certificates

- Revalidate tax documents

- Keep digital records of all cleaning jobs

Pro Tip: Use a digital CRM tool (like Notion, Trello, or Monday) to track renewals and compliance dates.

FAQs – Cleaning Business License (2025)

Q1. How much does a cleaning business license cost?

Costs range between $50–$500 USD, depending on country and license type.

Q2. Can I start without a Cleaning Business License?

You can start informally, but legal contracts require licensing for insurance & tax purposes.

Q3. What if I work from home?

Home-based cleaning companies still need local trade permission or municipal NOC.

Q4. Is a Cleaning Business License valid internationally?

No. Each country requires local registration, but your experience helps get new approval faster.

Q5. Can I operate under another company’s license?

Only if you’re subcontracted. Otherwise, you must hold your own.

🔗 Sources – Cleaning Business License

Internal Links:

External Links:

Expert Advice: Cleaning Business License

Getting your Cleaning Business License is not just about paperwork — it’s the foundation of trust, professionalism, and long-term growth. Once licensed, your company can bid on commercial contracts, collaborate with property developers, and even expand internationally.

Remember: Legality = Credibility = Profitability

Start small, stay compliant, and scale confidently — because 2025 is the best time to launch your cleaning business worldwide. 🌍

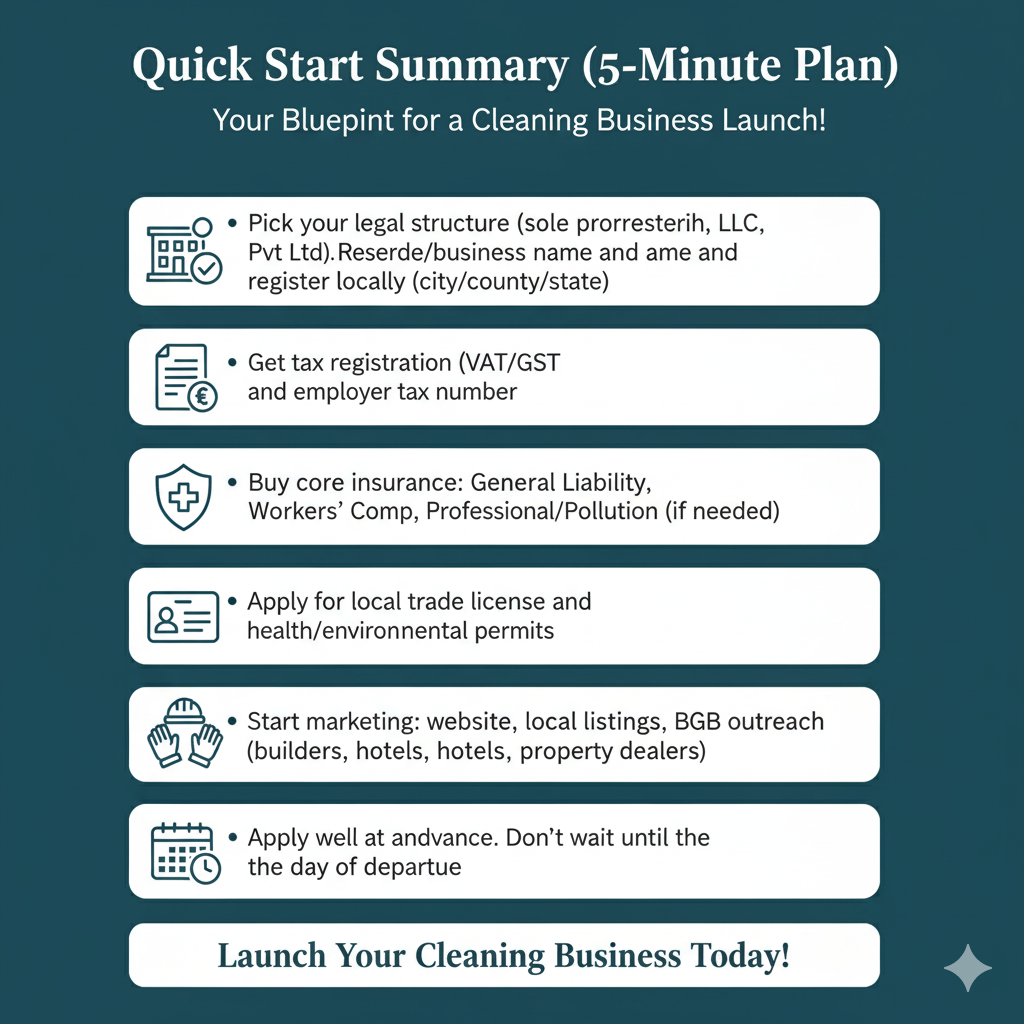

Quick start summary (5-minute plan) Cleaning Business License

- Pick your legal structure (sole proprietorship, LLC, Pvt Ltd).

- Reserve a trade/business name and register locally (city/county/state).

- Get tax registration (VAT/GST and employer tax number).

- Buy core insurance: General Liability, Workers’ Comp, Professional/ Pollution (if needed).

- Apply for local trade license and health/environmental permits.

- Get basic PPE + staff training and safety plan.

- Start marketing: website, local listings, B2B outreach (builders, hotels, property dealers).

1. North America (USA & Canada)

- What you need

- Business registration: State/provincial business registration + federal tax EIN/BN.

- Local business license (city/county).

- Sales tax / GST/HST registration (if applicable).

- Employer registrations: payroll tax, unemployment insurance.

- Permits: if you use pesticides/pest-control or industrial chemicals, get environmental permits.

- Insurance (must-have)

- General Liability (limits commonly $1M per occurrence / $2M aggregate).

- Workers’ Compensation (state-mandated).

- Commercial Auto (if vehicles are used).

- Pollution/Environmental liability (if using hazardous chemicals).

- Search terms: “how to register cleaning business [state name],” “business license [city name] cleaning service,” “workers comp cleaning service [province/state].”

2. Europe (UK, EU)

- What you need

- Company registration (Companies House in UK; national register in EU country).

- VAT registration (if turnover threshold reached).

- Local municipal permit or trade license sometimes required for commercial cleaning.

- Health & Safety compliance (e.g., UK: HSE guidelines).

- Insurance

- Public/ Employers’ Liability (UK requires Employers’ Liability cover).

- Professional Indemnity (if offering specialized services).

- Commercial vehicle insurance.

- Search terms: “cleaning business registration UK,” “public liability insurance cleaning company [country].”

3. Middle East (UAE, Saudi, Qatar)

- What you need

- Free zone vs mainland company setup (DED license in Dubai; municipality license).

- Specific cleaning service activity code during license application.

- Local sponsor requirements in some countries.

- Municipality/health authority approvals for sanitation services.

- Insurance

- Public liability.

- Workmen compensation (local labor law compliance).

- Motor insurance for vans.

- Search terms: “cleaning license Dubai DED,” “sanitization license Abu Dhabi municipality.”

4. South Asia (Pakistan, India, Bangladesh)

- What you need

- Business registration (NTN/FBR in Pakistan, GST & MSME registration in India).

- Municipal trade license may be required per city/cantonment.

- Labour & social security registrations for employees (EOBI/Social Security).

- Environmental NOC if using chemicals.

- Insurance

- Public Liability (strongly recommended for contracts).

- Employee health/worker insurance (EOBI, social security).

- Vehicle insurance.

- Search terms: “cleaning business registration Pakistan,” “trade license cleaning service [city],” “EOBI registration employer.”

5. Australia & New Zealand

- What you need

- Business registration (ABN/ACN in Australia).

- Local council permits.

- Work health & safety (WHS) compliance.

- Insurance

- Public liability, workers’ compensation (state-based), professional indemnity (optional).

- Search terms: “register cleaning business Australia,” “WHS cleaning business requirements.”

6. Africa & Latin America

- What you need

- Local business registration and municipal trade license.

- Tax ID and VAT registration where applicable.

- Environmental/health approvals if chemicals used.

- Insurance

- Public liability when doing commercial work.

- Employer liability / worker coverage as required.

Detailed checklist: Legal & registration (step-by-step)

- Decide structure — Solo; Partnership; Private Limited/LLC.

- Why: determines tax, liability, bank accounts, and insurance needs.

- Register name & business — Reserve name, register with national company registry or tax authority.

- Get tax IDs — Employer ID/EIN/NTN; VAT/GST if expected turnover threshold.

- Get local trade license — Municipality/City Hall; often required to operate.

- Open business bank account — Keep finances separate.

- Sign up for payroll & social contributions — Local social security; EOBI-style systems.

- Contracts & T&Cs — Create service contracts: scope, rates, insurance clauses, indemnities. (Sample wording below.)

- Health & Safety plan — Prepare SOPs for chemical handling, PPE, training logs.

- Data protection & privacy — If collecting client data, comply with local data laws (GDPR-style where applicable).

Insurance: coverages you must consider (with sample limits & why)

- General / Public Liability

- Why: Covers client property damage or injury claims.

- Sample limit: $1M per occurrence / $2M aggregate (or local equivalent).

- Employers’ / Workers’ Compensation

- Why: Pays for employee injuries on the job — often legally required.

- Format: State-mandated in many countries (US, Australia), social security contributions in others.

- Commercial Auto

- Why: For service vans and vehicles transporting staff or chemicals.

- Professional Indemnity (optional)

- Why: For advice or if you guarantee specific results (e.g., mold remediation).

- Pollution & Environmental Liability

- Why: If using disinfectants, solvents or dealing with hazardous waste — covers cleanup & claims.

- Contents / Tools Insurance

- Why: Covers your equipment, vacuums, steamers, etc., from theft or damage.

- Business Interruption (optional)

- Why: Protects revenue if you must pause operations due to insured events.

Tip: Always ask insurers for a “cleaning services package” — providers often bundle covers at discounted rates.

Insurance clause sample (for client contracts)

“Contractor shall maintain, at its own expense, Public Liability Insurance with limits not less than [currency & amount], Employers’ Liability/Workers’ Compensation as required by law, Commercial Auto insurance for vehicles used, and any other cover as reasonably required by Client. Contractor shall provide certificates of insurance upon request and name Client as an additional insured where required for the project.”

Operational & compliance checklist (before first contract)

- Written SOPs for cleaning, disinfection, and waste disposal.

- PPE inventory (gloves, masks, aprons, eye protection).

- MSDS (Material Safety Data Sheets) for every chemical used.

- Staff training records & signed checklists.

- Equipment maintenance logs.

- Sample quotes and standard service-level agreements (SLAs).

Pricing & taxation considerations

- Price model options: per-square-foot, hourly, per-room, or per-project.

- Taxation: include VAT/GST where applicable; add service tax in invoices.

- Invoicing: issue compliant invoices (tax ID, registered business info, GST/VAT number).

- Retention: for large builder contracts, expect retentions (e.g., 10%) — manage cashflow.

Sales channels & target clients (priority order)

- Builders & property developers (post-construction)

- Hotels & serviced apartments (recurring contracts)

- Offices & co-working spaces (weekly/monthly)

- Real estate agencies (handover cleaning)

- Healthcare clinics & labs (specialized sanitization)

- Residential recurring services (maintenance cleaning)

How to get certified / credibility boosts

- ISO 9001 (quality) / ISO 14001 (environment) — long-term investment.

- NADCA or industry-specific certs for HVAC/duct cleaning (if offering HVAC).

- Local health department approvals for disinfection services.

- Training certificates for staff (OSHA, HSE, or local equivalents).

Sample startup timeline (first 90 days)

- Day 1–7: Decide business structure, secure name, open bank account.

- Day 8–21: Register business & tax IDs; order PPE & starter equipment.

- Day 22–35: Obtain local trade license and any required municipal permits.

- Day 36–50: Get insurance quotes and bind policies.

- Day 51–70: Build SOPs, hire staff, conduct training, get MSDS files.

- Day 71–90: Pilot projects, collect testimonials, bid for builder/property contracts.

Cost estimates (ballpark — varies by market)

- Business registration & licenses: $50–$1,000 (local variance).

- Initial equipment (basic): $1,000–$5,000 (vacuums, steamers, PPE).

- Insurance (annual): $600–$3,000 small biz; larger exposures cost more.

- Marketing & website: $300–$2,000.

Local enforcement & worst-case checks

- Always verify municipal registration — no single national standard.

- Keep records of licenses and certificates on file for client audits.

- For chemical use, check environmental rules (some countries ban certain disinfectants).

3 Comments