Cleaning Staff Insurance 2025: Ultimate Safety Guide

Running a cleaning business means ensuring your team is safe, compliant, and protected. Yet many cleaning startups overlook the importance of cleaning staff insurance — also called workers’ compensation insurance — until something goes wrong.

In this ultimate guide, we’ll break down how cleaning insurance works, what it covers, why it’s mandatory, and how you can get affordable coverage in 2025 while complying with your country’s labor laws.

In 2025, cleaning businesses face rising workplace safety regulations, client demands for compliance, and increasing injury-related costs. Whether you manage an office cleaning team or residential maids, having cleaning staff insurance isn’t just smart — it’s essential for long-term survival.

According to the U.S. Bureau of Labor Statistics, cleaning and maintenance workers face one of the highest injury rates among service industries.

Without insurance, a single injury claim could bankrupt a small cleaning company.

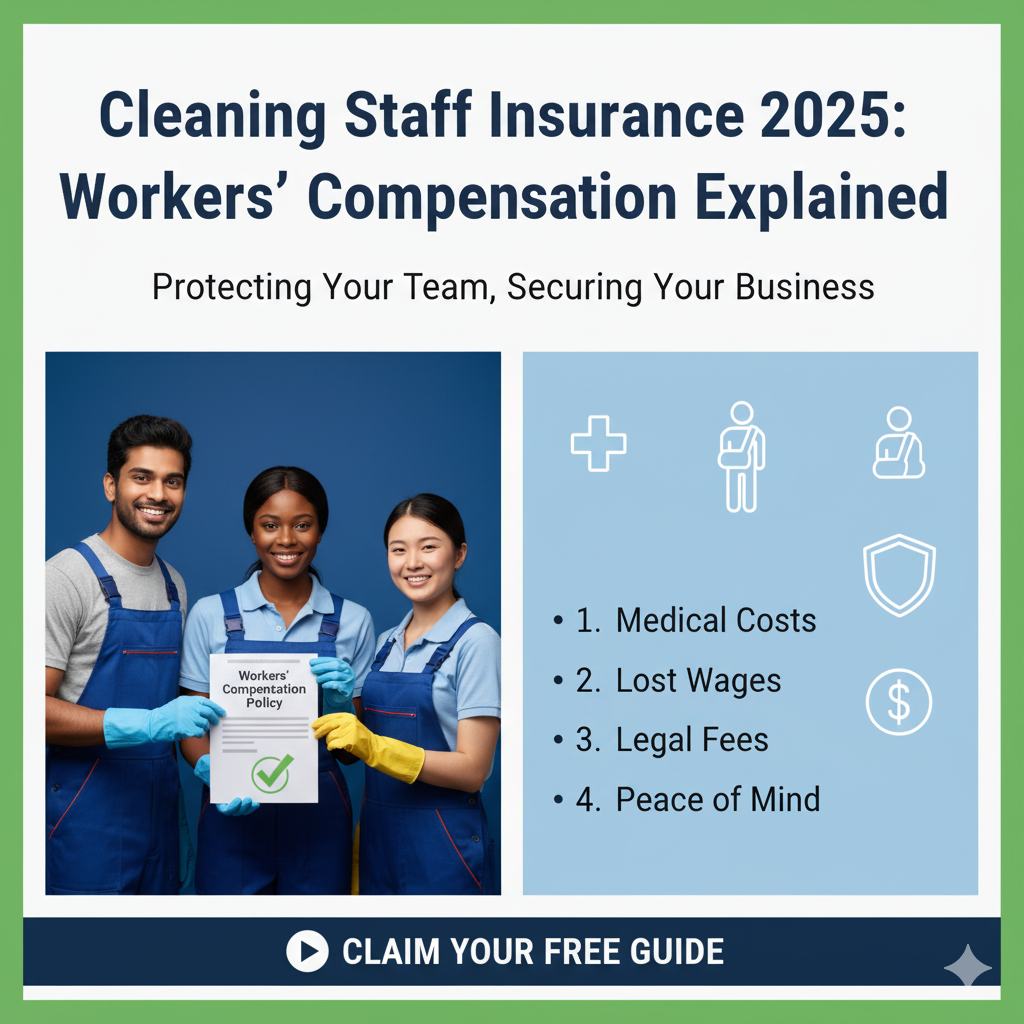

🏢 What Is Cleaning Staff Insurance?

Cleaning staff insurance (or workers’ compensation insurance) is designed to protect employees in case they get injured, fall ill, or die while performing cleaning duties. It ensures that medical bills, lost wages, and rehabilitation costs are paid — without dragging your company into costly legal disputes.

💡 Think of it as a safety net that keeps your team financially protected and your business legally sound.

According to the U.S. Department of Labor, employers in most regions are legally required to maintain active workers’ compensation coverage for any staff who handle physical work.

Example:

If a cleaner slips while scrubbing a tiled floor and fractures a wrist, workers’ compensation covers:

- Emergency treatment

- X-rays and medication

- Temporary income replacement

- Rehabilitation therapy

Why Every Cleaning Business Needs Workers’ Compensation

Here’s what happens when you don’t have coverage:

- Employees sue for negligence

- Clients refuse contracts without proof of insurance

- Regulatory fines or shutdowns

But with a valid cleaning staff insurance policy, you ensure:

✅ Legal compliance

✅ Staff safety

✅ Business stability

✅ Stronger reputation

🧍 Who Needs Cleaning Staff Insurance?

Virtually every business offering cleaning services should carry this policy:

- Commercial cleaning companies

- Residential maid services

- Janitorial contractors

- Carpet, window, and HVAC cleaning businesses

- Independent and part-time cleaners

Even freelancers benefit from basic coverage — it boosts client confidence and qualifies them for large cleaning contracts.

💰 What Does Cleaning Staff Insurance Cover?

| Type of Coverage | Description |

|---|---|

| Medical Expenses | Covers treatment for work-related injuries or illnesses |

| Lost Wages | Provides income support during recovery |

| Permanent Disability | Compensation for long-term injury |

| Death Benefits | Provides financial help to the worker’s family |

| Rehabilitation Costs | Physical or occupational therapy |

Tip: Combine cleaning staff insurance with public liability and property damage coverage for a complete safety net.

📘 Related Topic: Best Insurance for Cleaning Businesses in 2025

Common Workplace Risks Covered

Cleaning isn’t just sweeping floors — it’s physical, chemical, and repetitive.

Workers face daily hazards such as:

- Wet floors and slips

- Back strain from heavy vacuuming

- Chemical burns from cleaning products

- Respiratory issues from dust or mold

- Cuts and abrasions from broken glass

How to Get Workers’ Compensation for Cleaning Staff

Here’s the simplified process:

- Check local regulations – Requirements differ by country and state.

- Gather business documents – Licenses, employee lists, payroll.

- Request quotes from trusted providers.

- Choose coverage levels based on risk and staff size.

- Submit and approve your policy – then display your certificate.

📘 Related Internal Link:

👉 How to Get a Cleaning Business License Easily (2025 Guide)

How Much Does Cleaning Staff Insurance Cost?

The premium depends on:

- Payroll amount

- Number of employees

- Risk category

- Location and claim history

Typical range:

$0.70 to $2.80 per $100 in payroll.

Example: If payroll is $100,000, expect $700–$2,800 annually.

📎 Sources:

Check rates at The Hartford Business Insurance or Insureon Cleaning Business Policies

What’s Not Covered by Cleaning Staff Insurance?

- Fraudulent or intentional injuries

- Non-work-related accidents

- Substance-related incidents

- Delayed reporting of injury

- Contract disputes

Legal Requirements by Region

| Region | Mandatory Coverage | Authority |

|---|---|---|

| USA | Yes, in all 50 states | Department of Labor |

| UK | Required by law | Health and Safety Executive (HSE) |

| UAE | Mandatory for companies with employees | MOHRE |

| Australia | State-managed programs | WorkCover |

| Pakistan | Recommended for cleaning contracts | Provincial Labor Departments |

Check your region’s labor website before hiring cleaning staff.

How to File a Workers’ Compensation Claim

- Employee reports injury immediately

- Employer files claim with insurer

- Medical assessment and documentation

- Insurance company reviews and approves

- Employee receives benefits

Frequently Asked Questions (FAQs)

Q1: What is cleaning staff insurance?

It’s a policy that protects employees from job-related injuries and illnesses.

Q2: Is workers’ compensation mandatory?

Yes, in most regions it’s legally required for employers.

Q3: What if I have part-time workers?

They still need coverage; check your local thresholds.

Q4: How fast can I get approval?

Most insurers issue a certificate within 48 hours of payment.

Q5: Does it cover cleaning subcontractors?

Only if specified in your policy—verify before signing contracts.

Q6: Is there a deductible?

Usually no; benefits are paid directly to the employee.

Q7: What’s the penalty for no insurance?

You can face heavy fines or business license suspension.

Q8: Can self-employed cleaners apply?

Yes, many companies offer self-employed workers’ comp plans.

Q9: Are mental health claims covered?

Some modern policies include stress or trauma coverage.

Q10: Can I renew online?

Yes, through your insurer’s business portal annually.

Expert Advice:

In 2025, cleaning staff insurance is more than legal compliance—it’s a commitment to your team’s well-being. It ensures your cleaners work confidently, your business stays protected, and clients see your brand as responsible and reliable.

If you plan to grow your cleaning business globally, this insurance is your foundation for sustainability and trust.

6 Comments